Proposal Description:

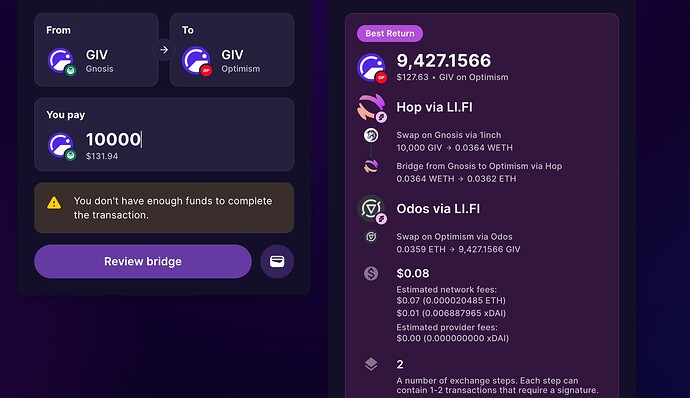

Giveth is gearing up to integrate a bridge via Connext to connect our liquidity on Optimism and Gnosis, a move aimed at facilitating seamless cross-chain swaps for the GIV token. This integration presents a golden opportunity to solidify liquidity and accessibility for GIV holders across both chains. We propose a staggered release plan for providing liquidity and actively participating in the bridge integration process.

Proposal Rationale:

Building this Gnosis Chain<>Optimism Bridge with Connext is a big boost for Giveth token accessibility, unlocking more liquidity and cross-chain activity. There are very few routes for moving money between these two chains and having GIV as an option will undoubtedly increase our on-chain volume and metrics helping us with RetroPGF and Speculators.

Connext’s integration further increases Giveth token benefits with Lifi, Metamask and other integrations without us needing to do anything.

Expected duration or delivery date (if applicable):

2 weeks max

Proposal Details:

Staggered Release Plan:

- Total Liquidity Allocation: 20 million GIV tokens (10 million on Gnosis Chain, 10 million on Optimism).

- Staggered Release Strategy: To carefully manage the process, we propose the following release schedule:

- Initial Add: 5,000 GIV tokens on each side (for 1 day)

- Second: 200,000 GIV tokens on each side (for 2 days)

- Third: 2 million GIV tokens on each side (for a week)

- Final: The rest.

Implementation Details:

- Almost No Development Required: Integration entails one line of code adjustment, replacing the link to Jumper with the link to Connext.

- Integration with Connext: GIV token will be seamlessly integrated as a liquidity route in platforms like LiFi and MetaMask Swap, enhancing accessibility and usability for GIV holders.

Next Steps:

-

Signal support on this forum post vote

-

Snapshot Vote: Initiate a DAO vote to approve the allocation of GIV tokens for the bridge integration.

-

Implementation: Proceed with the agreed-upon release schedule, test the bridge and coordinate closely with the Connext team to finalize the bridge integration to their frontend.

-

Monitor and Rebalance: Continuously monitor liquidity and user engagement post-integration, making necessary rebalances to optimize liquidity and ensure a seamless user experience.

-

Marketing Campaign: Promote the use of our bridge, increase activity for Optimism and potential RetroPGF rewards.

Team Information (For Funding Proposals)

@gereeroyale (Kay on Discord) to handle bridge liquidity

Skills and previous experience in related or similar work:

Kay is one of our awesome Devops and has set up our node ready to hold this liquidity.

## Funding Information

Amount of GIV requested:

20 Million (10 Million on Gnosis Chain. 10 Million on Optimism)

Ethereum address where funds shall be transferred: 0x79EfFa11d95931A7e1717f9Eb655eE43e35Ef265