Goals

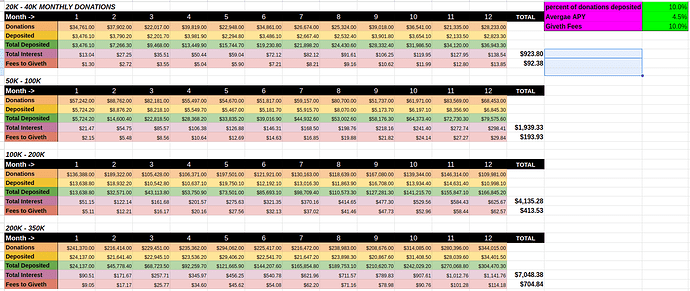

GIVfi aims to allow Projects, Donors and Investors on Giveth to easily tap into the power of DeFi and generate passive yield for public goods and projects on the Giveth platform.

Our goal is to make it easy and safe for projects and donors to get into DeFi, maximise their funding with minimal effort, and create sustainable income streams for Giveth.

GIVfi will feature two products, GIVsavings and GIVdaoments. GIVsavings is focused on allowing projects to earn yield on their idle donations. GIVsavings also allows donors to donate directly to a project’s GIVsavings. GIVdaoments will allow impact investors to deposit their own funds into on-chain endaoments which earn yield and distribute that yield to projects on the platform. Depositors into GIVdaoments keep their principal and donate the yield.

Both GIVsavings and GIVdaoments implement performance fees on yield earned and will provide passive revenue to the Giveth DAO.

Team and Resources

@mitch - Lead, Product Manager & Documentation

@Cherik and @alireza7612 - Front-End Development

Kurt - Smart Contract Development

@mateodaza - Subgraph Development

@Tossynee - Design

@maryam.jafarymehr - User Testing

@Griff - Product Advisor

@amin - Subgraph & Smart Contract Advisor

Communications & Marketing - TBD

Duration

Our immediate goal is to deliver the GIVsavings MVP which could be expected as early as mid Q3 2023. However our full vision of GIVfi, including multi-chain & multi-vault GIVsavings, GIVdaoments and scaling product growth could take up to 2 years to fully achieve.

Initial 3 Month Deliverables & Budgeting

The DAO will have the opportunity to vote on which budget and corresponding deliverables the WG will focus on for the next 3 months. There are three options:

- Grow - Increase the current scope and budget.

- Sustain - Maintain the current scope and budget.

- Shrink - Reduce the current scope and budget.

Grow

| Task |

Deliverable |

Expected Cost |

|---|---|---|

| Research on GIVdaoments technical implementation | Technical Specification of GIVdaoments | |

| Professional Auditing | Professional Audit of GIVsavings smart contracts | $50,000 |

| Development of GIVsavings MVP | Test deployment on the Giveth staging website | |

| User Testing | Begin user testing of GIVsavings MVP | |

| Launch communications prep | Communications Strategy for GIVsavings launch | |

| Documentation | First draft of user documentation for GIVsavings | |

| Salary Costs | $16,500 | |

| *10% Budget Buffer | $1,650 | |

| Total | $68,150 |

Sustain

| Task |

Deliverable |

Expected Cost |

|---|---|---|

| Development of GIVsavings MVP | Test deployment on the Giveth staging website | |

| User Testing | Begin user testing of GIVsavings MVP | |

| Launch communications prep | Communications Strategy for GIVsavings launch | |

| Documentation | First draft of user documentation for GIVsavings | |

| Informal Audit | Informal Audit of GIVsavings contracts from Giveth Galaxy friends | |

| Salary Costs | $13,000 | |

| *10% Budget Buffer | $1,300 | |

| Total | $14,300 |

Shrink

| Task |

Deliverable |

Expected Cost |

|---|---|---|

| Development of GIVsavings MVP | Test deployment on the Giveth staging website | |

| User Testing | Begin user testing of GIVsavings MVP | |

| Informal Audit | Informal Audit of GIVsavings contracts from Giveth Galaxy friends | |

| Salary Costs | $11,000 | |

| *10% Budget Buffer | $1,100 | |

| Total | $12,100 |

*Budget Buffers are included for any unexpected costs from operations, only if a portion or all of it is spent will another, proportionate, budget buffer be requested in the subsequent budget.

Approval Process

This WGP will remain available and open for Advice Process for 7 days, after which it will move to a Snapshot vote to decide the approved budget and scope.