HealthCredit

Like a carbon credit but for health.

We are proposing a protocol to fund health care in developing countries. We will use a mechanism similar to carbon credits, but using Life-Years (DALYs in industry jargon) as a unit of account rather than tons of CO2. And, of course, this will be on-chain.

We are looking for support and advice from the Giveth Community on the following:

- Finding a technical co-founder also passionate about this space

- Legal advice for how to launch this

We have had a meeting with Dann aka “Cotabe” at Giveth who suggested we make a post here. If you are interested in collaborating/advising please reply or DM on Twitter or Telegram (see links below).

Progress to date:

- DevWebsite.

- Website2 if DevWebsite is down.

- Our NFTs on OpenSea testnet

- The smart contract link

Motivation for this project

Imagine a rural maternal healthcare clinic in rural Kenya. They want to expand their impact but how do they convince funders half the world away they are really having an impact? And are doing so in a cost effective way?

Healthcare funders like corporations, governments and foundations want to improve health in developing countries but funders are unsure of the impact they are getting. Health interventions that could save lives go underfunded.

We’re all familiar with this: when we see a company’s annual report say “We are helping maternal health in Africa” we wonder “Are they? How much? And how sure are they?”

In the era of blockchains we need not be in doubt anymore.

Solution

Just as carbon credits represent a ton of carbon or equivalent removed from the atmosphere, we can tokenize health using DALYs (disability adjusted life years) as a unit of account.

Each HealthCredit represents a DALY averted. Each verified health care Project Developer gets a unique token of impact with their photo. Each accredited health organization can sell their tokens on a marketplace at the market price. The token uses the ticker symbol $LYS for “life year saved.”

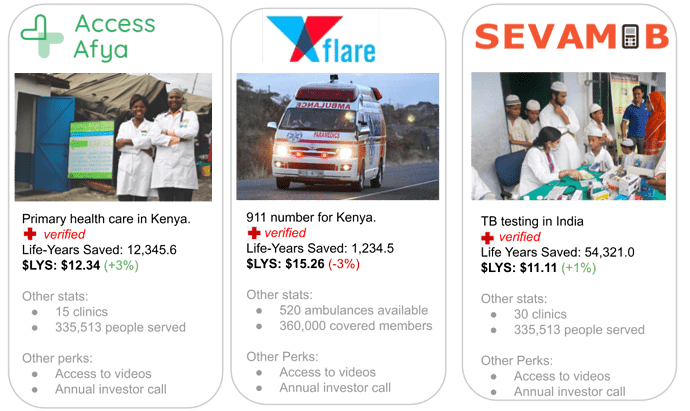

Here are example organizations with example stats:

Price of $LYS (the life-years saved ERC-1155 token) depends on the subjective view of the buyer. For example, an $LYS from a health center in rural Kenya might be worth more to buyers than an $LYS from a hospital in New York. This is similar to how carbon credits work, though the carbon credit solution is less elegant. Carbon credits were intended to be fungible (the price of 1 ton = the price of 1 ton), but in practice buyers are willing to pay a higher price for a ton of carbon from saving the amazon rainforest than a ton of carbon from a cement plant that reduces emissions by 5%.

NFTs and cryptocurrency is a good way to solve the challenge of subjective value of health improvement while simultaneously referencing a concrete impact. The picture on the token also maintains the emotional relationship to the project the DALY came from. Each health organization’s token will come with an image of the project so that people can keep it in their digital wallet, on their digital trophy wall or annual report. It will also link to a video of the work and may come with perks like visiting the project (for major patrons).

The number of $LYS for sale depends on how many DALYs an organization saves, which are subsequently verified.

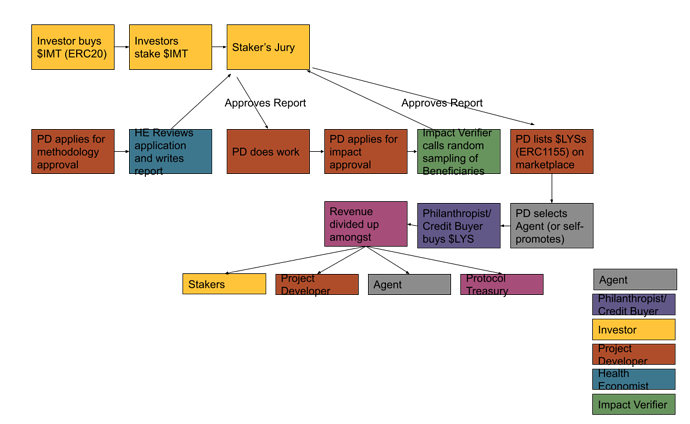

Verification is done through the governance ERC-20 token $IMT (or “Impact Token”). A random collection of $IMT stakers are chosen as a jury to approve or reject projects for the marketplace as $IMT stakers have an incentive to protect the protocol. (See more details in our draft whitepaper here. We encourage you to make comments directly on this draft white paper. Constructive criticism is helpful:-)

Here’s a summary of the governance:

Funding

Since we have an ERC-20 with a credible plan for Token Value Accrual we believe we can have an ICO or other crowdsale, perhaps on the Giveth website. We believe that doing an ICO on Giveth could attract other visitors to Giveth and potentially lead to a relatively large raise on the Giveth website.

Broader Appeal

- This is for retroactive funding but there could be a way to sell $LYS futures that help organizations acquire capital earlier.

- While we are starting with Healthcare, one can imagine our Impact Token used to govern projects in other sectors in the future. But starting with one specific use case seems like a good place to start.

Team Information

Kyle Schutter founded, ran and sold a biogas company in Kenya where he also sold carbon credits. Now he raises capital for startups in Africa at thegrant.co. He is looking for new ways to crowd capital into the space. He was red pilled on crypto when he ran a Thai restaurant in Kenya and one patron asked to pay in BTC. When Kyle checked his bitcoin wallet a few years later he realized that was the most profitable Pad Thai he ever sold.

We have submitted this idea to the EthDenver virtual hackathon and were a winner of the Impact Track, winning $5,000 where Griff was one of the judges. Also part of the Hackathon team were

- Himanshu Bhatt (India)

- Godswill Ezeoke (Nigeria)

Advisors:

- Melissa Menke: Founder Access Afya Kenya

- Andrea Feigl: CEO at Health Finance Institute

Thanks for reading. If you are interested in collaborating/advising please DM me on Twitter or Telegram or reply here.