Summary:

Deploy GIV to Polygon Network and upgrade GIVeconomy (GIVfarm, GIVstream) to support and reward GIV stakers and QuickSwap/SushiSwap Liquidity Providers.

Proposal Rationale:

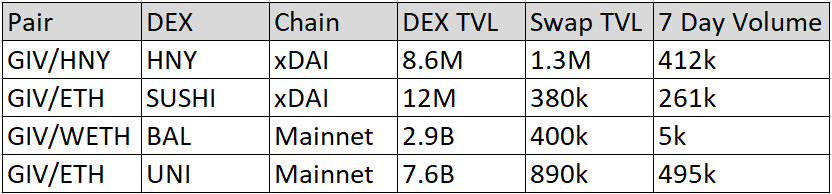

In the weeks following the launch of the GIV token, Giveth has seen a tremendous amount of liquidity enter both the Ethereum and xDAI pools:

Note: DEX TVL pertains to listed chain only

With the exception of Balancer’s poor 7-Day Volume, it is easy to see that GIV’s liquidity is healthy and being utilized regularly.

Aside from Curve Finance, SushiSwap and UniSwap are the largest DEX’s by TVL on xDAI and Mainnet, respectively – HoneySwap and Balancer not far behind. On Polygon, QuickSwap has $771M TVL, the highest of any Polygon DEX – more than SushiSwap, UniSwap, and Balancer combined. Tapping into this liquidity would undoubtably augment the GIVeconomy, allowing it to flourish in the blooming Polygon ecosystem. In addition, the extraordinarily low fees on Polygon will expedite onboarding of new GIVers by lowering the barrier to entry.

Finally, Polygon uses a modified version of Tendermint and is able to upgrade to IBC support. This means that Polygon can connect with and become part of the Cosmos ecosystem in the future. Integrating with Polygon now has the potential to place Giveth inside another rapidly growing ecosystem, again multiplying liquidity growth and advancing DAO goals.

As proposed in the “Final GIV Distribution Proposal”, an arbitrage opportunity will be made available in the form of a Polygon native SushiSwap GIV/ETH pool (SushiSwap is the 3rd largest DEX on Polygon after QuickSwap and Curve).

Proposal Description:

Deploy GIV ERC-20 smart contract on Polygon Network, ensuring that the contract can connect to the user’s MetaMask wallet, display the user’s wallet balance, and allows the user to send and receive GIV on the Polygon Network. Number of decimals should be the same as on the Mainnet token contract.

Upgrade the GIVfarm to:

- support Polygon Chain and allow staking GIV via Polygon Chain

- support Polygon QuickSwap GIV/ETH Pool

Allocate 1.5% of the liquidity from the 6.50% “Later Mining” GIVmining/staking allocation to incentivize staking GIV (0.5%) and providing QuickSwap (0.5%) and SushiSwap (0.5%) liquidity.

Update (1/8/2021):

Alternatively, the GIVfarm could be upgraded so that the Mainnet and xDAI staking features for Balancer and SushiSwap (respectively) could accept LP tokens from identical pools on Polygon. For example, a user could provide liquidity to Polygon Balancer GIV/ETH pool then use Wormhole to bridge the LP token to Mainnet and stake in the Polygon GIVfarm. This would allow Giveth to tap into Polygon liquidity without drawing from the “Later Mining” rewards, all while saving users gas fees.

Expected Delivery Date:

Upon each proposal passing, the multisig will aim to integrate with Polygon in 8 weeks.

Team Information:

Contacts: @chadfi

Multi-Sig: Need volunteers!