Hello everyone! It’s coming up on 5 months since we did the first treasury management exercise. I wanted to give an update, propose some changes to our strategy and also revisit our reimbursement

Revising the Reimbursement Scheme for Giveth Contributor costs

We recently got a notable amount of funding from the Optimism Retroactive Public Goods Funding. Somewhere to the tune of ~280k DAI. We also should be getting some more from our current fundraising efforts.

Given this big win I would suggest we begin covering 50% of our costs for at least the next 5 months. We should start using the funds to meet our financial obligations and remove a huge part of the financial burden from @Griff .

We can also try out 40% which would give us about 6 months at the current rate.

Or also do 100% which would not quite cover 3 months at our current spending rate.

How would this work?

I would suggest we keep it simple for now and continue the reimbursement scheme by sending funds to Griff in 50% DAI and 50% GIV so we make sure we can put these funds to use immediately and contributors remain getting paid punctually. We should begin doing this with our repayment for April 2023.

We’ll revisit this scheme 3 months later and draft a plan if we need to make any changes.

Revisiting our ETH Strategy

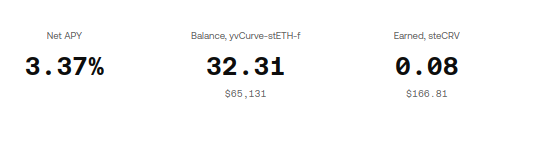

Here’s our current status and earning thus far:

So far about $160 in yield earned and with a net APY of ~3.3%. I do think we could do better, I would suggest we migrate this ETH currently in Yearn over to icETH. If you don’t know about icETH it is a product from https://indexcoop.com/ who we are actively pursuing partnership with. icETH uses Liquid Staking Tokens and AAVE to get a higher yield than regular ETH staking rewards. Sitting around 5.6% we could net a few extra percentage points of yield.

icETH is also a token that can be simply swapped for which deceases the cost significantly of managing our ETH position, we don’t have to deposit or withdraw out of a vault contract, it’s just a simple token swap and you’re in!

Check out icETH here:

Revisiting our DAI Strategy

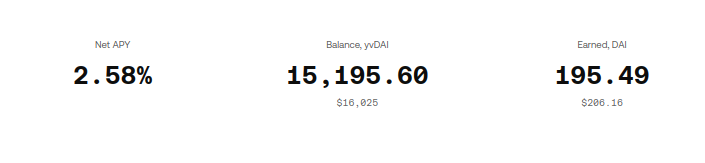

Current status for DAI here:

DAI had a good run for a bit with as high as 7% APY, it has come back down since then. We’ve netted about $200 in yield, again however I think we could do better.

Idle Finance has been around for a while, I know @willy is a big fan and I believe ShapeShift has some sort of partnership with them… correct me if I’m wrong here.

They have some more competitive yields for DAI - consistently between 4-7% for their Senior Pool. The Senior Pool includes a certain amount of guaranteed protection in case of any exploits or technical failures. The Senior Pool insurance is collateralized by the Junior Pool - which offers higher returns with more risk exposure.

You can check out the DAI pool I had in mind here:

In what amounts…

We currently have about 15k in the DAI vault with a further 17k DAI sitting idle from our DAOdrops grant. This brings us to 32k right now that are eligible to be deposited in a new strategy. We could also put in an additional 18k to bring us to a flat 50k in deposits.

If we really want to go big we could throw in an additional 68k and take us up to 100k flat in DAI deposits, but we would probably need to pull it out in a few months to pay for things…

Those are the options, my favourite however is bringing us up to a flat 50k in DAI deposits and not needing to touch it for +6 months.

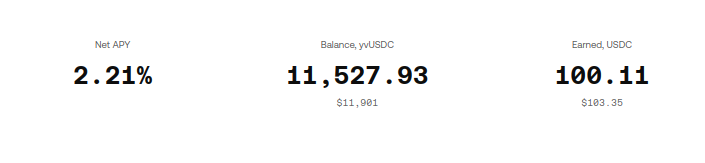

Revisiting our USDC strategy

Not so hot is USDC, the return on Yearn has been pretty dismal compared to other vetted protocols out there.

I would like to suggest two protocols: Goldfinch and again, Idle Finance.

Both offer yields above 6% and are very solid protocols. Goldfinch requires Government ID from a non-US person to create a Decentralized Identity for the depositor. I’m not sure this will work out via a multisig but it could be worth a shot - the yield is generally the highest of the safe yields I’ve seen out there.

If Goldfinch doesn’t work I would recommend Idle Finance, going into a Senior Pool that works similar to what I outlined above for DAI.

In what amounts…

Currently we don’t have much in new deposits in USDC… there is about ~4k from our Polygon grant on Polygon that we can either bridge to mainnet, which could cost $40-60 in gas and deposit into the strategy we choose on mainnet or attempt to find a suitable vault on polygon. None of the protocols I mentioned already are active on Polygon. I believe the only safe option on Polygon would be this Beefy Pool

Beefy is a well vetted protocol that has been around a while, however it does not offer the same mechanism of loss protection offered by Idle Finance.

Multisig Links

giveth-main on mainnet

giveth-main on polygon

Pollzzz

Should we begin reimbursing our costs in DAI?

- 50% Reimbursement Coverage in DAI

- 40% Reimbursement Coverage in DAI

- 100% Reimbursement Coverage in DAI

- Nothing, maintain the current reimbursement scheme in only GIV

- Something else… will comment

0 voters

Should we switch up our ETH yield strategy?

- Move everything to icETH from Yearn

- Don’t move any ETH from Yearn, only swap new ETH to icETH

- Do nothing.

- Do something else… will comment

0 voters

Should we switch up our DAI strategy?

- Yes! Move everything to Idle Finance - 32k total deposit

- Yes! Move everything to Idle - 50k total deposit

- Yes! Go big - Move everything to Idle - 100k total deposit

- Only move unstaked funds to Idle… will comment an amount

- Do Nothing.

- Do something else… will comment

0 voters

Should we switch up our USDC strategy?

- Yes! Try to move everything from Yearn to Goldfinch, if not Idle Finance.

- Do nothing

- Do something else… will comment

0 voters

What should we do with the USDC on Polygon?

- Bridge to mainnet, deposit into our chosen strategy

- Deposit into Beefy Vault

- Do nothing

- Do something else…will comment

0 voters