Not so much concerned about the team member dealing with the task, I trust any experienced Giveth member. I am concerned about hacks, especially after I got my cellphone compromised.

Worth taking a look at these links:

I guess we have to take look at similar experiences about the cash ratio among other DAOs in this business to have a clue.

Thanks @mitch for creating this post. I think DAO Treasury Management is such an important topic.

Additionally, learning on the DAO Treasury Management can be applied to Givfy to improve the process before automating.

I think there is a lot to dig into already in the post and even more to come. For example, I think quick-to-implement is preferable with the current treasury. However, more secure would be much better after the fundraising team efforts start to pay off even if it makes transactions slower. What’s the threshold?

I’m in favor of concentrating assets in one or a few currencies. However, if we go ahead with your plan of reaching out to the big dogs and ask them if they would be up for streaming money for pubic goods. Then maybe liquidating their assets could have a bad optic.

I also think is a good practice to keep our Treasury Diversified. Not liquidate all ETH for Stable or Stable for ETH.

I would keep both an ETH and a Stable strategy. Ratio between ETH and Stable may vary based on the markets, but IMO keeping both would be a good practice as we grow.

ATM, I think close to a 50:50 ratio would be a good idea, as I think we are in a crab market. But there are more experienced people on this topic than me.

Maybe there was some confusion here … I wasn’t suggesting to hold in only ETH or stables…

So the question is more what do we do this these odd tokens here? leave them be or turn them into ETH or stables and earn yield on them?

Hi Mitch,

This is not financial advice nor any advocacy to make any decision one way or another.

Just some information on how we are doing so you are informed: Aragon is, in my opinion, in its best state as an organisation in the last 2 years. 2 incredible product launches coming and the long-awaited movement of funds into the new Aragon DAO. New leadership team set up from 8 months ago has changed everything for the better.

Info on the new protocol: Meet The New Aragon Protocol

Strategy: Building the Hyperstructure for Governance: Aragon’s New Strategy

More info on the new DAO coming in the new year. And you could also look into treasury information as well to make a good decision for Giveth!

Much love ![]()

-Anthony

I think we keep our partners/friends tokens (GNO, ANT, HNY, etc)

Keep all GIV tokens (put it in the Hodl vault if there is over 10k USD worth?)

Keep all amounts smaller than $750 (gas makes it not worth it)

Okay! I think we got enough feedback to begin the process. I will carry this out today and tomorrow.

Here is a summary of what we will do:

- Use Giveth Main funds to generate passive income

- Use stables accrued through $nice token program to generate passive income

- Bridge our Gnosis Chain stables in Giveth Main to Mainnet, use to generate passive revenue.

- Liquidate assets that are not partner tokens (ANT, HNY, NODE…), GIV or ETH into stables, use to generate revenue.

- Generate passive yield for Matching pool funds with DeFi (revenue stays in matching pool)

- Liquidate funds in the Matching Pool not GIV, or stables or partner tokens into ETH, generate passive yield.

- Move stables in Liquidity multisig into Mainnet, generate passive revenue.

Strategies

Since there are no other contenders we will stick to the aforementioned Yearn vaults:

Execution

Mitch (moi) will carry out execution with oversight from another contributor. We will keep a record of movements through this spreadsheet:

I will use this address to carry out the transactions:

0x06263e1A856B36e073ba7a50D240123411501611

Update

@Cotabe and I pulled this off a few hours ago today. We completed the DAO treasury management plan along with sending out all the user funds that were left in Giveth TRACE! Double Whammy! ![]()

Here’s the final results:

- 14,069.48122 USDC Deposited into Yearn USDC Vault

- 15,830.94354 DAI Deposited into Yearn DAI Vault

- 34.2 ETH Deposited into Yearn steCRV Vault

- 2256.744788 USDC worth of yvUSDC sent to Giveth Matching

- 0.146584 ETH worth of yv-steCRV sent to Giveth Matching

You can see the transactions sent and received here:

Mainnet - https://etherscan.io/address/0x06263e1a856b36e073ba7a50d240123411501611

Gnosis Chain - Address 0x06263e1a856b36e073ba7a50d240123411501611 | GnosisScan

Hello everyone! It’s coming up on 5 months since we did the first treasury management exercise. I wanted to give an update, propose some changes to our strategy and also revisit our reimbursement

Revising the Reimbursement Scheme for Giveth Contributor costs

We recently got a notable amount of funding from the Optimism Retroactive Public Goods Funding. Somewhere to the tune of ~280k DAI. We also should be getting some more from our current fundraising efforts.

Given this big win I would suggest we begin covering 50% of our costs for at least the next 5 months. We should start using the funds to meet our financial obligations and remove a huge part of the financial burden from @Griff .

We can also try out 40% which would give us about 6 months at the current rate.

Or also do 100% which would not quite cover 3 months at our current spending rate.

How would this work?

I would suggest we keep it simple for now and continue the reimbursement scheme by sending funds to Griff in 50% DAI and 50% GIV so we make sure we can put these funds to use immediately and contributors remain getting paid punctually. We should begin doing this with our repayment for April 2023.

We’ll revisit this scheme 3 months later and draft a plan if we need to make any changes.

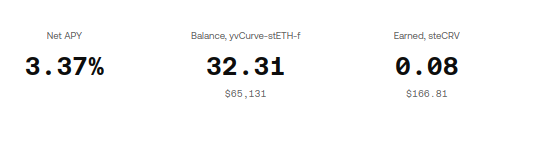

Revisiting our ETH Strategy

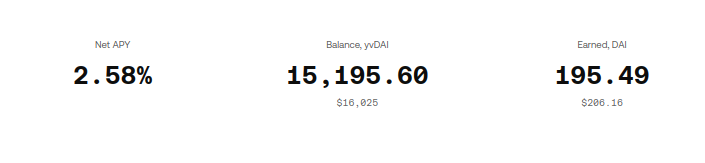

Here’s our current status and earning thus far:

So far about $160 in yield earned and with a net APY of ~3.3%. I do think we could do better, I would suggest we migrate this ETH currently in Yearn over to icETH. If you don’t know about icETH it is a product from https://indexcoop.com/ who we are actively pursuing partnership with. icETH uses Liquid Staking Tokens and AAVE to get a higher yield than regular ETH staking rewards. Sitting around 5.6% we could net a few extra percentage points of yield.

icETH is also a token that can be simply swapped for which deceases the cost significantly of managing our ETH position, we don’t have to deposit or withdraw out of a vault contract, it’s just a simple token swap and you’re in!

Check out icETH here:

Revisiting our DAI Strategy

Current status for DAI here:

DAI had a good run for a bit with as high as 7% APY, it has come back down since then. We’ve netted about $200 in yield, again however I think we could do better.

Idle Finance has been around for a while, I know @willy is a big fan and I believe ShapeShift has some sort of partnership with them… correct me if I’m wrong here.

They have some more competitive yields for DAI - consistently between 4-7% for their Senior Pool. The Senior Pool includes a certain amount of guaranteed protection in case of any exploits or technical failures. The Senior Pool insurance is collateralized by the Junior Pool - which offers higher returns with more risk exposure.

You can check out the DAI pool I had in mind here:

In what amounts…

We currently have about 15k in the DAI vault with a further 17k DAI sitting idle from our DAOdrops grant. This brings us to 32k right now that are eligible to be deposited in a new strategy. We could also put in an additional 18k to bring us to a flat 50k in deposits.

If we really want to go big we could throw in an additional 68k and take us up to 100k flat in DAI deposits, but we would probably need to pull it out in a few months to pay for things…

Those are the options, my favourite however is bringing us up to a flat 50k in DAI deposits and not needing to touch it for +6 months.

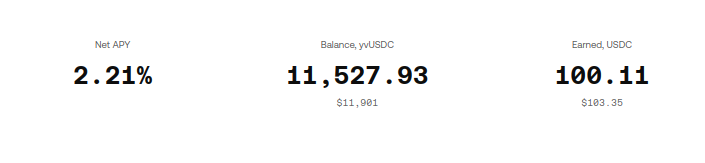

Revisiting our USDC strategy

Not so hot is USDC, the return on Yearn has been pretty dismal compared to other vetted protocols out there.

I would like to suggest two protocols: Goldfinch and again, Idle Finance.

Both offer yields above 6% and are very solid protocols. Goldfinch requires Government ID from a non-US person to create a Decentralized Identity for the depositor. I’m not sure this will work out via a multisig but it could be worth a shot - the yield is generally the highest of the safe yields I’ve seen out there.

If Goldfinch doesn’t work I would recommend Idle Finance, going into a Senior Pool that works similar to what I outlined above for DAI.

In what amounts…

Currently we don’t have much in new deposits in USDC… there is about ~4k from our Polygon grant on Polygon that we can either bridge to mainnet, which could cost $40-60 in gas and deposit into the strategy we choose on mainnet or attempt to find a suitable vault on polygon. None of the protocols I mentioned already are active on Polygon. I believe the only safe option on Polygon would be this Beefy Pool

Beefy is a well vetted protocol that has been around a while, however it does not offer the same mechanism of loss protection offered by Idle Finance.

Multisig Links

giveth-main on mainnet

giveth-main on polygon

Pollzzz

Should we begin reimbursing our costs in DAI?

- 50% Reimbursement Coverage in DAI

- 40% Reimbursement Coverage in DAI

- 100% Reimbursement Coverage in DAI

- Nothing, maintain the current reimbursement scheme in only GIV

- Something else… will comment

0 voters

Should we switch up our ETH yield strategy?

- Move everything to icETH from Yearn

- Don’t move any ETH from Yearn, only swap new ETH to icETH

- Do nothing.

- Do something else… will comment

0 voters

Should we switch up our DAI strategy?

- Yes! Move everything to Idle Finance - 32k total deposit

- Yes! Move everything to Idle - 50k total deposit

- Yes! Go big - Move everything to Idle - 100k total deposit

- Only move unstaked funds to Idle… will comment an amount

- Do Nothing.

- Do something else… will comment

0 voters

Should we switch up our USDC strategy?

- Yes! Try to move everything from Yearn to Goldfinch, if not Idle Finance.

- Do nothing

- Do something else… will comment

0 voters

What should we do with the USDC on Polygon?

- Bridge to mainnet, deposit into our chosen strategy

- Deposit into Beefy Vault

- Do nothing

- Do something else…will comment

0 voters

Thanks for looking into our DAO treasury @mitch

I think these are great suggestions based on good research of alternatives.

I really like the idea to use the funds raised to start reimbursing our costs in DAI. I think the 6 months of runway that 40% reimbursement covers it’s a good time to aim as a Fundraise WG goal to increase that runway and maybe eventually increase the percentage too.

I also like the idea of stepping up the yield strategies for the DAO & voted on my preferred options. Let’s go BIG and earn yield of the idle treasury.

I think we should consider moving off of mainnet… the gas fees are just dumb and don’t seem to be less dumb anytime soon what if we look at Arbitrum, Optimism or Polygon?

It might be interesting to do our repayments through polygon or another chain that has better off-ramping

However looking at the state of DeFi - From what I have found is that the best and most secure opportunities tend to hang out on mainnet. We can try to migrate our yield earning strategies to another chain but likely we’ll end up with something that either yields less and/or is less secure of a protocol.

I’m totally down to be proven wrong if someone can find good, SAFE, opportunities outside of Ethereum Mainnet

I’m in agreement here with both this suggestion and @mitch’s response that for DeFi, it can’t happen YET.

My support is with the proposed short-term strategy detailed here for now; and let’s put a longer term strategy into development for determining whether we go with Arby, OP or Poly next.

atm, it might be worth it to leave them alone. (why? cuz the % gain is so pathetic. you move it from one low number, to another low number (even a hair higher) and you spend all that you gained in the first one.

maybe NEW funds, should go into the better setups.

(also things seem to fluctuate alot)

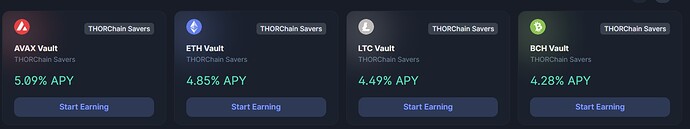

anyone look at thorsaver vaults?

course, the only one that would fit would be the eth vault.

I wrapped up this yesterday! We have successfully moved ~100k DAI and ~12k USDC into http://idle.finance/

I also minted us 35.4 icETH using 37 ETH on Index Coop

Lastly, I returned the leftover ETH in the account.

You can see all the transactions I made here: https://etherscan.io/address/0x9cd1E4A6b3361abcCC90C7F8E788ac246d194303

You can check for the funds on our multisig here:

It was fairly expensive to mint the icETH, but we had no choice since swapping for such a large amount would have incurred >10% slippage losses. I hope we don’t need to touch it for a while. ![]()

GM! Looks like the investments going GREAT :-D! icETH was a GREAT move!

We have about $250k (excluding GIV) in our multisig! AMAZING!

I want to ask for some help.

I am suffering a bit of a liquidity crunch because of a lack of client income from GM and an investment of resources into Optimism. RetroPGF will reward us (hopefully) for the work we have done this last quarter, but now we are in a tight spot until March when RetroPGF rewards are flowing.

Is it possible to request that Giveth cover 80% of costs with it’s treasury for the next few months?

I would propose we reassess in March when we all (Giveth, Pairwise, Praise, Giveth House, Regen Score, Commons Stack, Grants Management, RetroPGF Community, etc) have rewards flowing to us from RetroPGF3 and can cover their own costs.

Our range from around $70,000-$120,000 depending on how much we contract with General Magic, and how many hours are charged by our hourly contributors (which we should try to reduce in the short run).

We also have Income coming in! 5 ETH Just today were won by ENS small grants, and we shoudl get ~$10k from polygon for running their QF round, as well as, hopefully we can find more GM clients for Giveth contributors to support.

If we can keep costs low for the next few months, 80% of our costs will be around $60k a month and we should be able to cover November, December, January and February without major issues, especially if we continue with our other revenue streams: QF, Grants, & Consulting via GM.

Thoughts?

I support that Giveth should shoulder 80% of costs in the next months, and reimbursing @Griff 80% of non-GIV tokens. Griff has been more than generous to receive GIV tokens as reimbursement for the compensations costs of our contributors. It’s likely he won’t sell the GIV tokens he receives and I believe Giveth has the capacity right now, so I strongly support this proposal.

This is you requesting, so THAT’s possible ![]()

Can Giveth’s treasury pay out $240,000 over the next 4 months?

In order to say yes I would like to know:

- Present Treasury balance

- What percentage of the Treasury is requested for this proposal?

- What tokens would you propose we pull out of which multisigs for that?

- Staking rewards or other value being generated by Treasury holdings that will be impacted?

- Would this be in GIV tokens and can we estimate any token price impact if that will be liquidated?