Hey folks! After some discussion with @Griff and others in the GIVeconomy research call I would like to bring up a few opportunities we have to generate some passive revenue for funds held in our multisigs. ![]()

Namely let’s take a look at these four multisigs:

Currently, most of these multisigs are slowly accruing stable tokens and ETH from donations, including those to the main multisigs through the $nice token program. ![]()

![]()

Giveth Main Multisigs

We have about $13k in stables on Mainnet and another $6k in stables on Gnosis Chain. There’s also 10 ETH on mainnet and another 7 ETH coming in from the old Giveth multisig. ![]()

So $19k in stables and 17 ETH - However meager, we could be making some passive revenue on this, right? There’s also other assets we could consider liquidating into ETH or DAI such as ANT or UNI held in the multisig. More on that a bit further below. ![]()

$nice Token

We mentioned at the outset of the $nice token program that we would use 50% of the income from stables to buyback GIV and combine it with the other 50% to create DAO-owned GIV liquidity. As we near $10k USD accrued in stables, directly or indirectly from $nice we should consider if we follow through on the original plan or reconsider our priorities. From my perspective we have a few options I would like signals on:

- Stick to the plan. Create GIV/DAI liquidity

- Use the stables to generate passive income

- I have another idea… will comment

- Abstain

0 voters

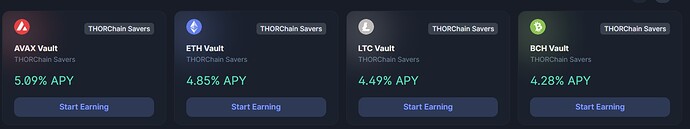

In whatever outcome from the poll above, I would like to propose we begin staking some or all of these funds into low-risk, well vetted DeFi strategies such as Yearn, Curve or Balancer. We should also consider bridging our stables to mainnet from gnosis chain in order to have a better field of opportunities to invest.

Should we use our Giveth Main holdings to generate passive revenue?

- Yes!

- No!

- Maybe later…I have comments or concerns

0 voters

Bridge Stables from Gnosis Chain to Mainnet

- Yes

- No

- Abstain

0 voters

Should we liquidate assets that are not GIV, ETH or stables into something else?

- Liquidate everything into ETH

- Liquidate everything into stables

- Only some assets into ETH… will comment

- Only some assets into stables… will comment

- No liquidation!

0 voters

Giveth Matching Pool

A similar idea to the Giveth Main multisig proposal is to put the funds held in our matching pool to generate some passive yield for the matching pool itself - There hasn’t been much movement inside the pool and there isn’t a notable amount on Gnosis Chain but we could put those funds in mainnet to work! As mentioned in GIVmatching - Idea Generation on how to distribute funds - #21 by mitch We set a starting goal for GIVmatching at $500k USD of collected funds - we are still very far from that goal. ![]()

Lets get some signals:

Should we generate passive yield for the Giveth Matching Pool with DeFi?

- Yes!

- No!

- Maybe later…I have comments or concerns

0 voters

Should we liquidate assets in the Matching Pool that are not GIV, ETH or stables into something else?

- Liquidate everything into ETH

- Liquidate everything into stables

- Only some assets into ETH… will comment

- Only some assets into stables… will comment

- No liquidation!

0 voters

Liquidity Multisig

This is a bit less of a priority but from the actions we took during the GIVfarm hack a month ago we broke apart all DAO owned liquidity pools - including a GIV/DAI position we held on Univ2. This was done to mitigate the hacker from effectively selling GIV they stole on the open market ![]() . So there’s about 4k DAI and a boat load of GIV in the multisig - what should we do?

. So there’s about 4k DAI and a boat load of GIV in the multisig - what should we do?

What should we do with these stables?

- Reform the GIV/DAI liquidity on Mainnet

- Move the stables to the Main multisig and generate yield on Defi

- Nothing.

- I have a different idea… will comment

0 voters

Strategies

Suffice to say, there is no shortage of DeFi strategies we could implement to generate yield but I’d like to ask we make some important considerations:

- The funds should be on a chain that is very accessible and well reputed.

- We could need to access and cash out the funds at any given moment. Probably not prudent at this time to use a strategy that requires us to lock up funds for a given duration.

- Strategies should be well-vetted, battle tested and low risk. I generally use DeFi Safety to get a feel for a projects quality and security before investigating further.

- Whatever we do should require minimal overhead or management.

I’d leave this forum post to actively gather suggestions for strategies. I’ll add my three favourites here in the ring:

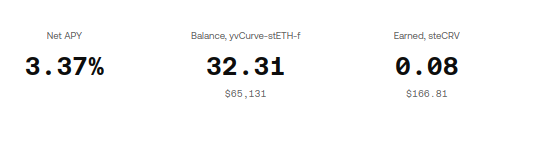

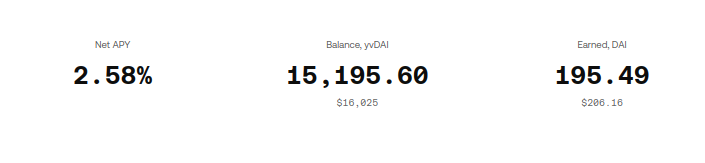

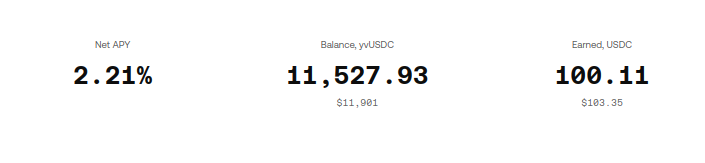

DAI

USDC

ETH (stETH/ETH)

I’ll leave it there! Looking forward to see your preferences and suggestions. ![]()

How to get it done (if anything)

There’s two routes I see to actually putting anything we decide here into action:

Do everything through the multisigs.

The most secure and decentralized manner would be do go through the process inside the multisigs. This include bridging, swapping, approving, staking etc… etc… for every single action we need to pass a multisig vote. It’s slow, error prone and consumes a lot of collective bandwidth to pull off, but it is the most secure way.

Get a trusted person or entity to do it.

The fastest and easiest way to do it would be to transfer all the eligible funds out of the multisig(s) and get a trusted individual or entity to do all the minute work and then return the LPs, wrapped tokens, deposit placeholder tokens etc… all back to their respective multisigs. This is not a very secure or decentralized way but it would save a lot of time and collective bandwidth and likely avoid some technical headaches and hurdles.

If we choose the latter option I would nominate myself to pull this off. I’m fairly savvy with DeFi and blockchain and I have enough social and financial collateral that I would feel like a trustworthy candidate. My collateral includes:

- A hefty GIVstream

- My job

- My personal reputation and relationship with all of you

One last poll for good luck ![]()

How should we get this done?

- Do it all through the multisigs

- Get a trusted person or entity to do it. But NOT Mitch, I wouldn’t trust that guy with a carton of eggs.

- Plz do it Mitch

0 voters