Following the GIVeconomy research call yesterday we broached the subject of creating continous revenue streams for Giveth. ![]()

This is a huge impact discussion and likely will impact every corner of Giveth. This discourse is LONG overdue but now we’re dusted off and back in action.

I expect an exciting discussion. Let’s dive in. ![]()

The Problem and the Status Quo

Giveth has been around for a while, by crypto standards it is friggin’ ANCIENT ![]() . Yet a twinkle in @Griff’s and Jordi’s eyes in 2016, the donation platform was officially conceived in 2017

. Yet a twinkle in @Griff’s and Jordi’s eyes in 2016, the donation platform was officially conceived in 2017 ![]() . For many, many years, Griff has been the biggest and best benevolent patron of Giveth, keeping the lights on and the show rolling. We cannot thank you enough for the contributions and risks you’ve beared to keep the dream alive.

. For many, many years, Griff has been the biggest and best benevolent patron of Giveth, keeping the lights on and the show rolling. We cannot thank you enough for the contributions and risks you’ve beared to keep the dream alive.![]()

Giveth has never been as successful as it is now. We are a huge team of talented and motivated professionals and we are making waves in the blockchain industry. We have all the right pieces to take this thing to the moon and define the narratives of ReFi and BlockchainForGood. ![]()

Our problem is that we simply do not have the funds to keep pace with the rate that our team and platform is growing. ![]()

The missing link in our equation is that while our platform becomes more successful, our DAO doesn’t have the means to keep pace and grow. This comes mostly to a bottom line of securing funding to support contributors, external builders and projects on our platform.

Also, at our current emissions our token is proving to be quite inflationary and we need buy back strategies to grow the market cap of GIV and create more value for our token holders.![]()

To that end it is time to get serious about becoming sustainable and introducing a real business model to bring in continuous revenue and liquidity to our DAO…

Goals

In my perspective, introducing any sort of fees or revenue models should serve many purposes, including:

- Buying back GIV off the market, allowing the token price to grow

- Accruing DAO owned liquidity

- Recapturing distributed GIV for future programs

- Paying contributors

- Supporting projects on our platform, public goods, web3 events and the Ethereum ecosystem.

Solutions

Over the course of a few GIVeconomy research calls and a few 1:1’s with a few of you I found a few viable solutions. I would like to present these as some initial steps towards generating revenue and meeting the aforementioned goals.

Fees on Donations

This is the where Giveth has the highest volume of funds being moved. This is also the clearest and primary function of the Giveth platform, making donations. I realize Giveth has always marketed itself as “zero-added fees” but this is proving to be a challenging and frankly unsustainable model. ![]()

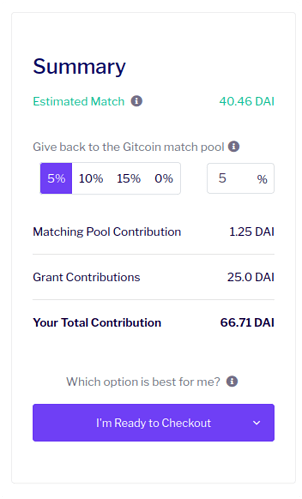

Gitcoin Grants already have an interesting system of having a default percentage added to the donation amount that goes back to their program.

Users by default can accept the 5% fee added on or they can opt to remove it, or even increase it. This to me seems like a great way to move forward.

Another option is an obligatory fee that is leveraged on every donation, being communicated clearly to the user with the fee percentage decided by the DAO instead of the donor.

In either case a quick and dirty solution for leveraging fees is to generate two transactions for every donation, sending some funds to our DAO and the rest to the recipient. This isn’t great UX, and can be costly on Mainnet but can likely be done quickly. However protocol fee contracts and functions already exist that can suit our purpose and have been used for a while by protocols such as Aave, Uniswap and Balancer.

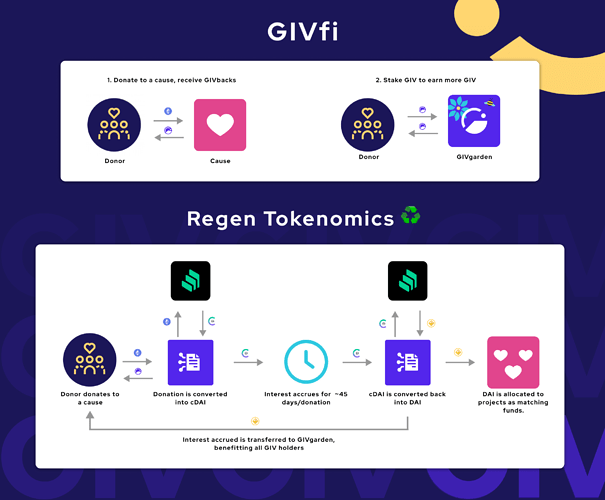

GIVfi v0.1

Effectively, any sort of smart contract acting as the donation intermediary would become the base for GIVfi, allowing us to add more strategies for capital deployment via upgrades to the smart contract architecture. ![]()

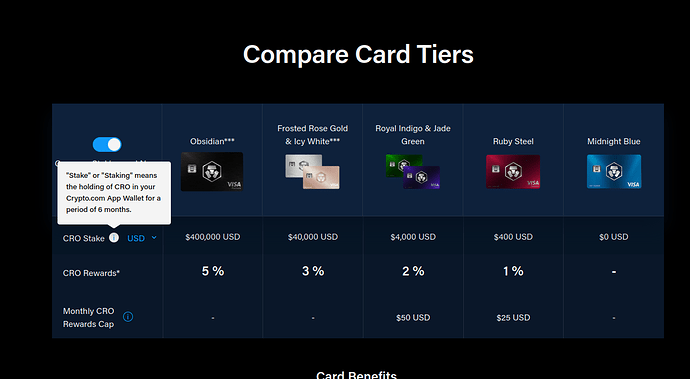

Fees in the GIVfarm

Many protocols during DeFi Summer (2021) introduced fees on making deposits or withdrawals into liquidity mining/yield farming programs. This is not a new strategy, but it is an effective one. This would be a way of accruing DAO-owned liquidity in the form of deposited LP tokens and recapturing GIV tokens on single-asset farms.

There are two options on this route, three actually, to take fees on new deposits into the staking program, to take fees on withdrawals, or fees on both deposits and withdrawals.

Giveth could also extend this functionality to the RegenFarms program since we should recognize that the GIVfarm is not a forever product and our goal is to eventually not need farming programs for liquidity. ![]()

My personal preference is fees on deposits, being leveraged clearly and upfront and not changing the deal for stakers who have already deposited their tokens into our farms.

\

\

Where Does Revenue Go?

Ideally all revenue and fees go to the Giveth Main Multisig to be redistributed.

I have heard some suggestions sending a portion to the GIVmatching Pool however I think at this point in the game we should really to focus on ourselves and our financial health before focusing on other projects. ![]()

In the Short-term…

Assuming any or all of this comes into effect, doing it properly will take time. We have a jam-packed roadmap and we’ll have to signal how urgent this is versus other planned features, decide all the nitty gritty details and then give time to the developer and design teams to work their magic. ![]()

@MoeNick has been cooking up a Token Log for us to do just this sort of signalling - which can be found here:

In the short-term I want to stress we will likely need to rely on grants, donations and investors to begin accruing DAO funds, creating financial runway and moving away from the benevolent benefactor model. ![]()

Polls - Time for Signalling!

Fees on Incoming Donations?

- Default Donation Fees, user can change

- Mandatory Donation Fees, DAO can change

- NO FEES

0 voters

Fees on GIVfarm?

- on Deposits

- on Withdrawals

- on Both Withdrawals and Deposits

- NO FEES

0 voters

Fees on RegenFarms?

- on Deposits

- on Withdrawals

- on Both Withdrawals and Deposits

- NO FEES

0 voters