GM! Sorry for the epic post, but there is a lot to discuss here.

Prequel

I started writing this post before the very extreme liquidation event that the ICHI community suffered from via “Bad Debt” in their Fuse Pool on Rari. This event took their token price from $120 to $12 in ~14 hours and down to below $2 in 2 days.

This was not because of their Angel Vault or Branded Dollar products, it was because of a poorly parameterized Fuse Pool that allowed untrusted parties to over leverage themselves with ICHI. We should obviously not follow suit.

IMO we use this pool for one thing, get the FEI we need to launch our Angel Vault and Branded Dollar. If we keep that narrow scope in mind at launch, the process can be designed to be safe and beneficial for our community without having to worry about these liquidation events.

We should be prudent and restrict the pool to the behavior we want and expect and once we feel more comfortable, we can open it up for other things.

That said, I still think it is in our best interest to continue to progress towards launching these 3 epic products: Regen Pool, oneGIV and our own Angel Vault!

Background

These posts chronicle the experience pretty well

Don’t want to read all those forum comments? Here is a quick TL;DR:

Angel Vault

The Angel Vault is a structured UniV3 Pool that creates a massive buy wall on UniV3, reducing downward volatility, while also signaling to the market that the token has great liquidity.

Angel Vaults have been incredible at providing protection against price decline. They are not magical number go up machines, but it is the best way to provide liquidity on UniV3 that we have found.

Our Angel Vault would be working on the GIV / oneGIV pair… so first we need to launch our own “branded dollar” oneGIV. To launch oneGIV, we need a lot of stable token (USDC/FEI/DAI) and a lot of GIV.

What is oneGIV?

In short, it will be Giveth’s “Branded Dollar” which can be minted for 80% stable token (ie. FEI) and 20% GIV or redeemed for 1 stable token

What stable token do we use for oneGIV?

Tribe DAO said that if we use FEI for oneGIV then they will put in 10% of whatever we raise for the Angel Vault to help make the wall bigger (SOLD!)

How do we get the FEI to launch everything?

This was an adventure.

At first we were going to sell GIV at a discount for FEI so we could get the money, but there were a lot of obvious downsides to this approach… especially legally.

Then we were planning on a very complicated 3 way solution, where Tribe DAO launches their Turbo Product and then ICHI deposits their token into the Turbo program to mint FEI tokens and then they would loan us the FEI via their Fuse Pool and we would pay interest to them. I probably already lost you on all that, as it was overly complicated and depended on both ICHI and Tribe DAO hitting their roadmaps and supporting us… but as we all know, web3 roadmaps often end up delayed so the risk of issues arising in this plan was too high so we decided to simplify this plan into what I will present below ![]()

Ok… background over, lets get into the meat of the proposal…

Regen Pool - Borrowing & Lending for a Better World

Maybe the title above is a bit of an overstatement for the current proposal but if this MVP use case of our Regen Pool works out, then we will see what evolves into. It can become a very interesting puzzle piece for the GIVeconomy. Having our own lending and borrowing market that benefits projects on Giveth will be really cool and could have a lot of legs and be a huge thing for us.

Regen Pool would be the name of Giveth’s Fuse Pool.

Read more about what a Fuse Pool is here: Guide to Rari Capital Fuse — permissionless money markets | by Stakingbits | Stakingbits | Medium

TL;DR Fuse is an open and decentralized interest rate protocol that supports isolated interest rate pools, allowing pool creators to create customizable isolated interest rate money markets with any assets and allowing users to lend and borrow these assets

Giantkin (HERO) already has deployed a Fuse Pool for us:

https://app.rari.capital/fuse/pool/167

And there he already coordinated with Rari to make a vote to verify it!

https://snapshot.org/#/fuse.eth/proposal/0xd75cab98b9143d7a16504dad01a3322ce6855369ff6ca8d7b1685a4ac694a217

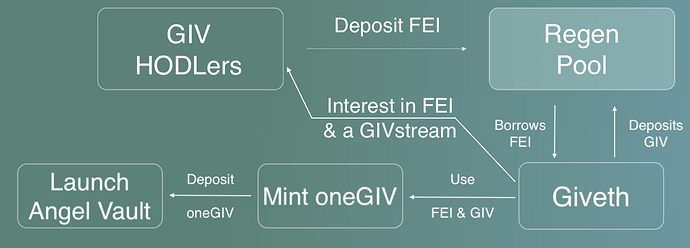

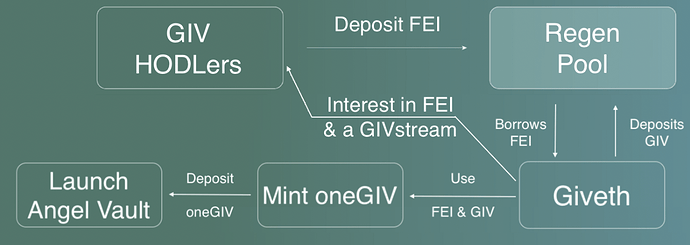

The plan is to configure this pool to incentivize FEI deposits from our community so that they earn very nice stablecoin returns, and then we, as the DAO, can put up GIV tokens as collateral to borrow the FEI, use it to create oneGIV and start our Angel Vault!

The process will look like this:

We are unlikely to default and have to liquidate a bunch of GIV like what happened to ICH for 3 reasons:

#1 We have a lot of GIV to collateralize the loan

#2 We are using the loan to make an Angel Vault which will protect against downward price volatility

#3 We will make sure no one else can default with GIV and cause a major drop by setting the cap for GIV to be exactly how much we want to deposit.

Param Party! Who’s Coming with me!

If there is a positive signal from the community in this forum post, we are going to dive deep into parameterizing this pool and want to involve YOU! The more people in our community that can understand Giveth’s Regen Pool, the more we can do with it!

We don’t have any fancy dashboards or any of that, we just hope to have thought provoking conversations and do our best to bring in as much wisdom as possible from our very wise community.

The configurable parameters for the Regen Pool are:

- Assets (tokens that are in our pool)

- Oracle for each asset (how do we get the price)

- Supply Cap for each asset (max number of tokens that can be lent)

- Borrow Cap for each asset (max number of tokens that can be borrowed)

- Admin fee (% of fees paid by borrowers that goes to Giveth liquidity multisig)

- Liquidation Incentive (additional collateral given to liquidators as an incentive to perform liquidations of underwater accounts)

- Whitelist (option for the pool to be permissioned for selected addresses)

- Close Factor (in the event of liquidation, max amount of collateral that can be liquidated)

- Upgradeability (whether the pool parameters can be modified)

- Collateral Factor (% that each $1 of collateral in that asset increases the amount a user can borrow limit, aka LTV)

- Borrowable (We can turn off borrowing for some assets)

- Reserve Factor (% of the interest paid by borrowers that goes to an insurance pool in the event something goes terribly wrong and pool becomes undercollateralized)

- Interest model (borrow/supply rate curves)

- Rewards for Deposits (GIV or GIVstream paid on top of the interest for depositing)

Things we should probably decide first relating to our overall strategy:

- Technical Feasibility of using the GIVstream for Rewards

- What are the defaults (Is it worth the gas to change them)

- Where do the Admin Fees go (donation.eth? giv.eth?)

- FEI Borrowing Strategy (do we wait to borrow FEI until we reach the goal)

- FEI Amount to Borrow (how big should our Angel Vault to be)

- GIV Overcollateralization (how much extra GIV do we want to put into the pool to keep it well-collateralized)

- Source of GIV (Does it come from the Liquidity Multisig? nrGIV? GIVgarden?)

- FEI Repayment Strategy (how do we plan to repay the loan)

Some Initial Thoughts on Overall Strategy

Technical Feasibility of GIVstream

Working with Amin and Pavle on this now… but if we can use the rewards system embedded into the Fuse Pool to distribute a GIVstream as opposed to distributing liquid GIV, we can offer much more attractive APRs.

Defaults cost money to change

GiantKin (HERO) configured the Pool already to have certain values and spent a lot of money on gas to deploy it (~$1000). If we don’t feel strongly about a parameter, we should probably leave it as it is.

Where do the Admin Fees Go?

If we want this to be a Regen Pool, we should make the fees go to donation.eth, if we want to use this to support Giveth as an organization, we can have it sent to giv.eth.

FEI Borrowing Strategy

As people deposit FEI into the pool, it becomes cheaper to borrow the FEI. We might end up in a bidding war to borrow the FEI. Should we just try to borrow some every day? Do we use a trusted party to do the borrowing, or do we use a multisig? How do we set the LTVs in a way that we can borrow the FEI that is deposited.

Amount of FEI to Borrow

Working with ICHI, they strongly advise that we make an Angel Vault that is at least 10% of the market cap to really intimidate the market. Currently our market cap is $5.5M but the market cap will go up when we use about ~$1.5M GIV to overcollateralize oneGIV and ~$3M GIV to overcollateralize our loan (see Regen Pool below). This will make our market cap ~$10M so to achieve the 10% market cap optics we will need 800k FEI.

GIV Overcollateralization

The overcollateralization of oneGIV is necessary so that the oneGIV currency has room to grow, this overcollateralization will be 750% to start but as people mint oneGIV this collateralization will shrink and the target is to be able to have 2M more oneGIV minted while maintaining a 250% collateralization.

The overcollateralization of our loan in the Regen Pool is to give FEI depositors confidence that we will not default, this overcollateralization will be 375%.

These are conservative estimates, the exact numbers we use will be further examined on this forum post, in discord and in our Param Parties, and will likely be lower than estimated here.

Source of GIV

This will be a lot of GIV, maybe we should consider pulling from multiple pools to make this happen?

FEI Repayment Strategy

If we are going to take out a loan, how do we pay it back? How long do we want to have this loan? How much money do we make in oneGIV if we push the price up? How long do we want to keep this loan? Is yield farming for the Angel Vault going to be enough to keep the wall strong? How much of the wall should be protocol owned?

So many questions, but they all need to be thought through so we can make our best guess for how we want to pay this loan back. The interest rate will be small, around 3-7%. If we borrow 800k that is 40k a year, which is about the cost of 1 team member. When thought of like that, in many ways it seems like a pretty awesome deal, but we need a plan for buying back the wall.

If you want to go fast go alone, if you want to go far, go together

If we go for this, we will open up 3 incredible products for our community:

- Regen Pool: A lending market that benefits projects on Giveth

- oneGIV: Our own stable coin

- Angel Vault: A structured Univ3 pool that can be farmed

But it won’t be easy, we will need to think a lot about how we design everything.

We have one of the most technically savvy communities in the nonprofit world, so much of our community has gone deep into the defi space and gets this stuff, let’s take on this challenge and set up a safe pool that will allow our community to loan us the FEI and earn a decent stable coin return, with almost no risk of liquidation.

If you have interest in helping make this happen we have started the discussion in the GIVeconomy channel on Discord: Discord

Should we create this Regen Pool to launch oneGIV and our Angel Vault

- Yes!

- Maybe, I will leave a comment with my thoughts

- No

- Abstain

thanks for hte conversations love it :0

thanks for hte conversations love it :0