Given the current state of the crypto market and the volatility of the GIV token, we want to reintroduce the Angel Vault as a simplified launch proposal, representing the culmination of a few months of discussion in mechanism design that we hope will create positive dynamics to support the Giveth ecosystem.

TL;DR

The Angel Vault is a structured Univ3 liquidity program for GIV/oneGIV that will be initialized & managed by a Giveth core team & ICHI multisig. oneGIV will be a Giveth-branded stable coin that will be initially 100% collateralized by DAI.

Anyone in the community will be able to add liquidity to the vault to earn rewards that are proportional to the amount of liquidity provided. The Angel Vault will provide significant liquidity for GIV on Uniswap, and protect the GIV token from downward volatility thanks to a moving “buy wall”.

Our Benefits

- A Giveth-Managed Univ3 Liquidity Pool

- Regular Univ3 liquidity programs benefit expert liquidity providers over regular community supporters. The Angel Vault is the best farming pool we’ve seen, offering fair rewards to liquidity providers while reducing token volatility. If we are going to pay for liquidity, this is the best way to do it.

- A Giveth-Branded Stablecoin

- Enables us to compensate the team with a stable token that further supports the Giveth ecosystem and provides the potential for further growth.

Our Requirements

- Engagement

- We need confirmation from the community as validation for this solution.

- Construction

- The Giveth team will continue to make progress toward the Angel Vault as underlying technical structures are deployed and capital is allocated.

- Support

- To increase the liquidity in the Angel Vault after launch, we will need the support of our community to stake Angel Vault LPs while earning a yield from Angel Vault farming.

- On-going Maintenance

- As always, new tools increase the technical debt of the ecosystem, and this will be no different. This system will need to be reviewed and maintained over time to ensure it continues to meet the changing and dynamic needs of the community.

Let’s Dig In!

The Angel Vault: Managed Uniswap v3 Liquidity Pool

The Angel Vault will be a structured Univ3 liquidity program, primarily managed by ICHI but with management power in the hands of Giveth core team and 2 members from ICHI in a 4/7 multisig.

The Angel Vault will be created using GIV & a yet-to-be-minted GIV-backed stablecoin, oneGIV. To set up the Angel Vault, the Giveth Community will create a large Univ3 position “buy wall” that consists of about 10% of the total market cap of GIV. This Univ3 position will help protect the GIV price from downward volatility if there are large sell orders.

If the price of GIV goes up, the wall stays where it is to maintain 10% of GIV’s market cap within it. If there is a sell order that eats into the wall (effectively removing stablecoins from it), the wall moves back to the point where its total value is still 10% of GIV’s market cap. The “buy wall” can actually consist of more than 10% of GIV’s market cap, and when that’s the case, it will be at the current price.

Anyone will be able to add liquidity to the Angel Vault, and will earn a yield in GIV for doing so.

oneGIV - A Giveth Branded Stablecoin

The Angel Vault will be based around Univ3 liquidity for GIV/oneGIV pairs. oneGIV will be a branded stablecoin backed by initially 100% DAI, and overcollateralized by GIV. Anyone will be able to mint oneGIV using $1 of DAI, or burn it for $1 of DAI. All these mints & burns will happen with a contract managed by a multisig of Giveth core team members.

Approx. $400k of GIV will be held in the oneGIV contracts (managed by the Giveth oneGIV team multisig) to be used as excess collateral in case there is an issue with DAI. Over time, the multisig may want to change the minting ratio so that minting oneGIV will require some % DAI and some % GIV.

Demand for oneGIV will be created through incentives for adding to the Angel Vault & perhaps additional incentive programs (such as oneGIV/xDAI) in the GIVfarm. To start, the only market for oneGIV will be against GIV, so in order to take advantage of Angel Vault rewards, people will need to sell ETH (for example) for GIV, and then sell GIV for oneGIV. Because 1 oneGIV can be minted/burned for 1 DAI, this also creates an arbitrage opportunity.

The DAI required to initially back the oneGIV to set up the Angel Vault will be provided by “Angel LPs”, i.e. backers who provide the stables to kickstart the program. They benefit from getting Angel Vault LP tokens that they can stake in the GIVfarm to earn rewards.

For more on the subject, there are interesting techniques and opportunities presented by oneGIV, explained at length here.

Angel Vault & oneGIV? What does that mean for GIV holders?

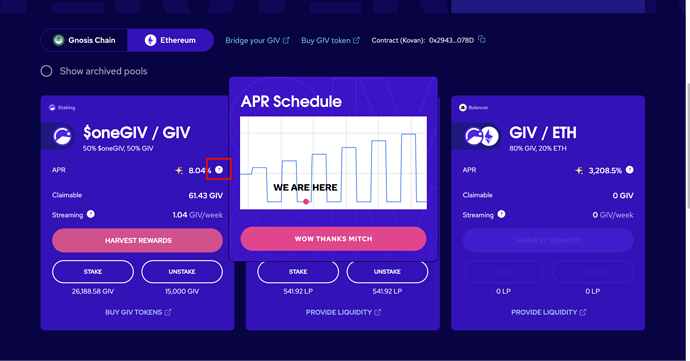

Anyone in the community will be able to add to the Angel Vault by simply adding oneGIV on ICHI’s website which will add to the buy-side of the managed Univ3 position for GIV / oneGIV. They will be able to stake their Angel Vault LP tokens in the GIVfarm and earn rewards proportional to the liquidity provided.

If you recall, we turned off our original Univ3 incentives program after learning that standard Univ3 programs benefit expert liquidity providers significantly more than the average user. This solution works to solve this, offering fair rewards to liquidity providers while getting the benefits of Univ3 liquidity.

A Note: The “Regen Pool” has been put on the shelf

If you’ve been keeping up with this discussion, you’ll recall that we were discussing getting the DAI to collateralize oneGIV initially from a borrowing/lending Pool called the “Regen Pool”. Sadly, Rari has turned off borrowing for Rari Fuse pools as a result of a small exploit, and given that their CEO recently resigned. We have negative trust that borrowing will be turned back on soon.

We have this as an option in the future, but for now, since 10% of the market cap is much less than it was before, we can still move forward with the Angel Vault program, without depending on the Regen Pool.

Incentivizing Angel Vault LPs

As mentioned we want to encourage our community to add liquidity to the Angel Vault so we’ll be providing an Angel Vault LP incentives program within the GIVfarm. When people stake their Angel Vault LPs, they will be able to earn a yield in GIV. Similarly to our other farming programs, part of the earnings will be distributed via the GIVstream.

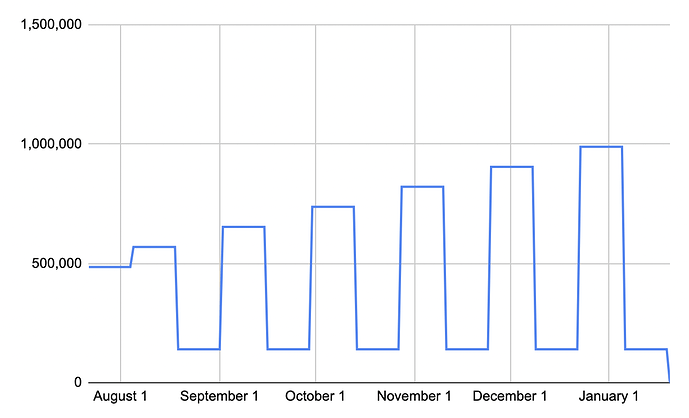

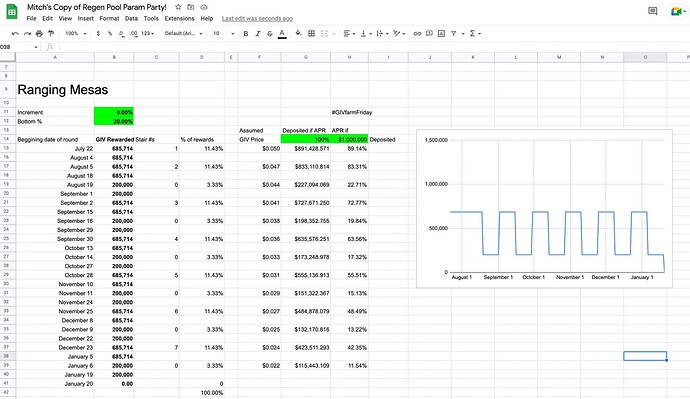

We hope to sustain around $400k of Angel Vault liquidity with APRs of about 125%. We assumed a GIV price of $0.04, meaning we will need 6 million GIV for a rewards program of 6 months. These calculations are reflected in this spreadsheet

In Conclusion

The Angel Vault and corresponding rewards program will:

- Provide significant liquidity for GIV on Uniswap v3

- Offer fair rewards to liquidity providers

- Protect the GIV token from downward volatility

- Create more demand for the GIV token through oneGIV

- Create an opportunity to generate funds through arbitrage, and

- Open the door to potentially more innovative economics using this system as a starting point

It is requesting the following from the liquidity mining multisig:

- Approx. $400k of GIV to over-collateralize oneGIV

- 6 million GIV to incentivize Angel Vault LPs

Should we start the Angel Vault & corresponding incentives program?

Please vote in Snapshot!

Resources

External

Angel Vault Basics

Univ3 Explained

Still relevant forum posts

Initial Angel Vault Proposal by ICHI

oneGIV & its collateral

Retired/concluded/closed but still relevant context forum posts

Raising money for the Angel Vault

The Regen Pool

Collateralizing the Regen Pool

Incentives for Regen Pool Depositors

Turning Off Univ3 Rewards Program

Stopping Univ3 Middle Finger Streams

Mainnet Liquidity Solutions

This forum post was written by @toddxy & @karmaticacid with significant support from @Griff , and feedback from @yass.