Summary:

Giveth’s mission is to reward & empower those who give. The Giveth governance tokens are used to reward donors to verified projects on Giveth. The Angel Vault provides an opportunity to protect the price of GIV from downward volatility and ensure the stability of Giveth, GIVbacks & the GIVeconomy into the future. We propose launching an ICHI Angel Vault to accomplish this goal without any new spending.

What is liquidity? How is ICHI’s Angel Vault different from other approaches to liquidity?

Liquidity on exchanges is necessary to maximize the value of the $GIV token for GIVbacks, for funding proposals via the GIVgarden, for expanding the DAO, and for governance.

Adding liquidity to DeFi has historically required placing your token up for sale on AMMs while centralized market makers also sell your token. This selling pressure would work against the value of Giveth’s rewards and reduce platform adoption.

Instead, we are proposing that the Giveth protocol manage their own community controlled liquidity via ICHI Angel Vaults on Uniswap V3. This system is designed to support the $GIV price while earning trading fees for the project.

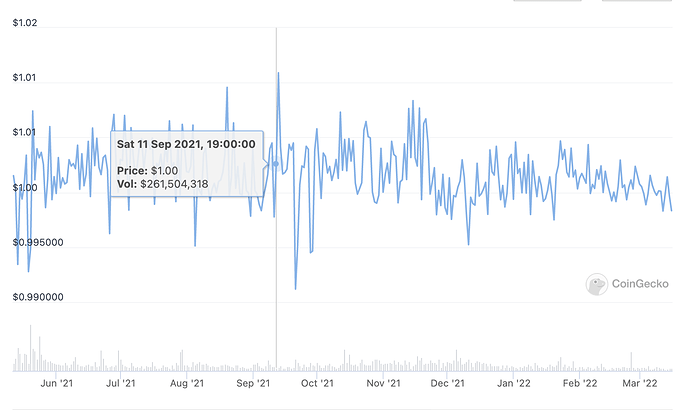

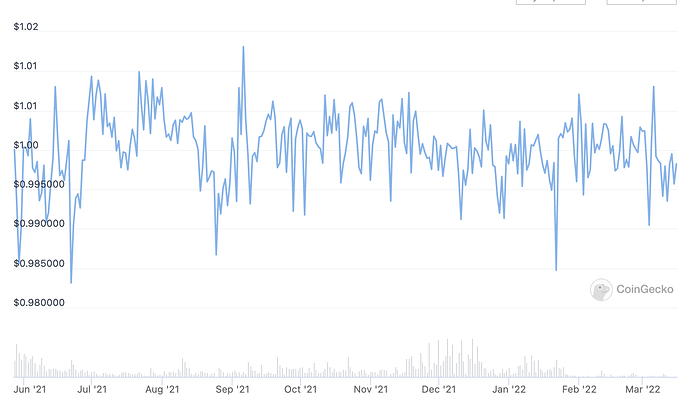

- Deposit $oneGIV, a token worth $1, into an Angel Vault smart contract to protect the price of $GIV from market declines

- Earn additional income for the Giveth treasury

- Create a new use for $GIV without impacting donor or project experience

Step 1: Create Stable Asset “Branded Dollar” for Giveth ($oneGIV) Token

$oneGIV would be a token worth $1. It would be minted with a combination of 80% stable asset pre-determined such as $USDC or $FEI and 20% $GIV. We are proposing that the Giveth community mint 4M $oneGIV and contributed to the Angel Vault by May 1, 2022

*Note to Giveth Community: You may use any stable asset to mint your $oneGIV. $USDC, $FEI, and $DAI are some suggestions.

Step 2: Create a Giveth Angel Vault

Allocate 5M GIV tokens to the Angel Vault position to drive the success of the token price and rewards for the Giveth community. The proposed budget by line item is in this spreadsheet.

What is needed? This spreadsheet explained.

As it stands today, 5 million $GIV is currently earmarked specifically for a Uniswap V3 Pool, so the ICHI DAO is proposing this goes directly into an Angel Vault in Uni V3. Some of this $GIV would be used to mint $oneGIV and some $GIV would be used as incentives for participants to engage in the Angel Vault. In order for Giveth’s Angel Vault to work, it must be backed by a stable asset i.e. USDC/FEI. The ICHI DAO has determined that $1 million is what will be necessary to start with a strong backing underneath the $GIV token price.

Keep in mind, these assets remain the property of the Giveth treasury and under the treasury’s full control. Also remember that once you adopt an Angel Vault, it is a liquidity strategy that must be maintained in order to yield its desired intended. Meaning that as the $GIV market cap rises, it is highly recommended that the community continue to contribute to the Angel Vault to keep 10% of market cap serving as your community’s price protection.

FAQ

Please click HERE to review our FAQ for ICHI Angel Vaults.

Technical Docs

Please click HERE for our Statement of Expected Behavior